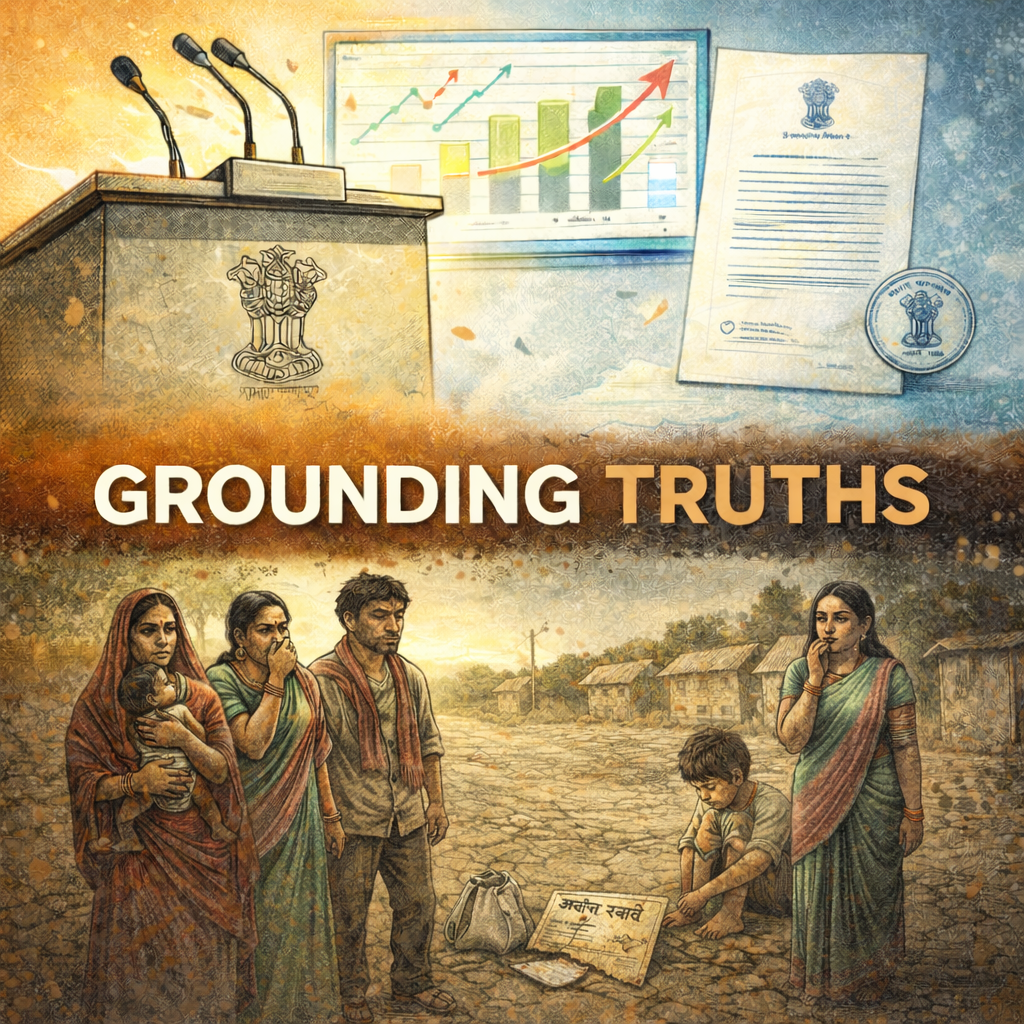

Last week we agreed that India has an unemployment problem. This, we said, is because the economy has had structural issues. Afterall - all countries do. We seemed to be trotting along at a reasonable rate until recently - the illusion of growth and better incomes seems to have been at least partly true. Then things went downhill at a rapid pace.

Science brings with it the idea of something called "precipitating factors". Precipitating factors refer to a specific event or trigger to the onset of a current problem as opposed to perpetuating factors which are those that maintain the problem once it has become established.

The structural problems of the economy have helped perpetuate economic degeneration, while the pandemic and poor policy has speeded the decline along. Most economists, now agree, that along with the unemployment problem India is also, undergoing, what is known as "stagflation". It is important to try and understand what this newfangled word is, since we've all learned new words this year - you know "pandemic" and all, stagflation is also a term we should all now add to our verbal repertoire.

Wikipedia will tell you that stagflation is a clever word that combines stagnation and inflation, it will also tell you that it describes a situation where there is a slow-down (you know - no new anything, innovation, progress, products...) and in addition everything suddenly becomes more and more expensive. What it won't explain to you - is that inflation (the increase of prices) is normally a good thing. In a normally growing economy, when people earn more per capita (a fancy way of saying more cash is earned per person), people spend more.

Much of the more-spending, is in spending more to buy the same broad categories of things, but at higher quality. Think of this as everyone buying entertainment, but maybe subscribing to more channels, or HD versions of the same channels.

Similarly, in an economy experiencing slow down or just general failure inflation should, theoretically, fall. That is, goods should become cheaper. Basic versions of things should return - the tomatoes should find space in your kitchen as opposed to a pricier more packaged tomato puree. It takes less skill or jobs as it were - to produce simple goods. A high degree of specialisation is not needed. Therefore a stalled slow economy, with low prices, ought to result in unemployment, a hoard of workers don't need to be employed by relatively simple industry.

The reason that stagflation is something of a strange creature is that it defies economic logic. In stagflation - unemployment is not a consequence of slow growth. Instead, it is the the rather bizzaire situation where slow-growth or no-growth is devastating the economy, and everything is becoming more and more expensive at the same time. Generally speaking, stagflation is the result of poor goverment policy. It usually happens when a) the government extends credit unreasonably through policy instruments or b) when it prints currency unsupported by a robust economy to back the volume of currency it prints.

It is also a bad policy conundrum to be stuck in. To address inflation, standard government response is tight fiscal policy which discourages borrowing and is overall bad for investment sentiments i.e. it does nothing for growth. If you can't borrow easily and neither can firms, you can't spend or save; which is a sign of deferred spending. To address growth, a borrowing friendly policy helps - but this just makes everything more expensive adding to inflationary tendencies, recall our argument about growth correlating with price increases.

What can a government do to increase rates of growth? As any student of economics will tell you - it can try and inject the economy with hope. How do you do that? You can encourage people to spend more, make loans cheaper, for instance, which is what India is trying to do with home loans now and encouraging more and more micro-borrowing by MSMEs and individuals. What doesn't help is this - a loan, even a cheap loan, is a loan. It needs repaying. Bororwing against nada is a bad idea. In a situation of high inflation, making loans cheaper, puts money into the hands of a people pushed against the wall, while doing zilch for their actual ability to repay.

All signs show that Mr. Stagflation has arrived in India, in style. The Indian economy contracted 23.9 per cent in the first quarter, that number though masks the real indicators of stagflation. Within that shrinking GDP number is the estimate of falling consumption demand and investment demand, at 27 per cent and a whopping 47 per cent. Nobody expects things to get better soon.

There are other indicators too - for example food prices have been going up every month by nearly 7% for nearly three quarters of the year thus far. Items, aside of food and fuel, are doing nearly as badly at 6% price rise on average, this depsite the fact that demand for goods is not there. Ironically, wholesale prices of things haven't gone up at all, so no - farmers and manufacturing folks aren't earning and yet you, and I, find potatoes ridiculously expensive. Stop and read that. Everything is more expensive for everyone (who are not buying anyway) and people producing the goods (such as farmers) are not earning anything.

Stagflation is a strange situation but certainly not uncommon. Contrary to popular perceptions it has happened more than once in history - not just in the 70s about oil, but also as recently as in the early part of the global recession, in 2008. We shouldn't really be surprised that we are now in stagflationary phase in India. How did we get here though? In my view there have been three different precipitating factors;

→ In 2016, the current government decided to demonetise currency selectively for a few currency notes, in a largely cash-run economy with seventy per cent people employed in the informal economy. It is well documented now that the currency notes of 500 and 1,000 accounted for over 86% of the currency in circulation then.

India's central bank subsequently said most of that money made its way back into the banking system. Given that India’s largest informal sector employer is agriculture followed by manufacturing, it is now obvious that the move was an epic anti-poor move. Not only did small businesses have to shut down but a record number of young people lost jobs, this was prior to the pandemic.

→ In 2017, the current government implemented the Goods and Services Tax (GST), intended as a simplified single tax code, to replace state revenue taxes. The GST is an oddly designed policy instrument and law. It places an inordinate burden on firms from a compliance and filing point of view with twenty-six different filings, monthly, quarterly and annual, the costs of which firms are to bear, and then there may be litigation costs.

The law requires that GST amounts be deposited, and paid to the government, even if invoices have not been paid out i.e. if income from sales has not been received. In India it is commonplace for businesses to remain without payment for inordinately long periods of time. In a country where most work is undertaken without contract, the law does not reflect the reality of doing business.

Further, the government is now facing an unprecedented crisis in terms of GST payment compliance. This coupled with stiff GST penalties for filing delays have caused Nirmala Sitharaman to state that the Center too is facing GST collection shortfalls. State governments have been complaining about a 2.35 lakh crore GST revenue pendency which the central government has failed to pay out.

Even in terms of GST rates, the GST council (a central authority) has been at the center of criticism, while choosing to tax essential goods such as menstrual hygiene products for women, at high rates, which was amended only in 2018 after public outrage.

→ Also contributing to India's stagflationary status is the general poor level of data and measurement. The current government has, to the dismay of many economists, made concerted attempts to conceal data regarding economic and social progress. In controversy after controversy, measures of GDP were recalibrated, destroying the ability to maintain concordance and meaningful comparisons between periods of time and the release of employment data was delayed repeatedly, prompting two senior government statisticians to resign in January 2020.

Regardless of the politics of data, at the heart of the question of how we are doing as an economy (and if we are indeed in stagflation) is measurement and data.

Like several nations around the world, the original approach, to measuring India's economic progress, was a simple counting exercise. Quantities of goods and services being produced were measured via a sample survey and the government then used the estimated prices for these goods and services to calculate growth. This method is not without problems, for example – it is almost entirely too sensitive to product prices.

The new method focusses on financial data reported to the government, specifically the financial results of 900,000 companies. What are the plausible flaws in such a system? Peruvian economist Hernando De Soto’s work has important clues. The main thesis of De Soto’s work on the informal economy is this: a market economy (a capitalist one) that excludes information about the informal economy (and its attendant lack of property rights and other welfare/legal rights), will always be dysfunctional.

India has been a country of cash-led, small businesses including agriculture, on which the vast majority of its labour force relies. The new measurement method suggests that the informal economy reflects the state of the formal economy in somewhat the same way that a mirror reflects the true you. However, India’s informal economy is not an index fund and it doesn’t reflect industry, it is quite the other way around. It is now well known that “Non-Inc India” did not take well to GST and is not taking well to the cashless economy.

While structural issues have always existed in the economy, a combination of policies that first systematically attacked India's growth engines via the informal sector (read demonitisation), then India's small businesses (read GST) combined with complete obfuscation of data, achieved what would have been difficult to come by in a normal economy. This is how we arrived at a situation of stagflation, policy led slow-down cemented via the pandemic which drove up unemployment.

When asked about unemployment, the government has oft responded saying that current data merely reflects the fact that people are more skilled now and as a proportion, more people are looking for jobs. It is hard to see why the government is optimistic about people looking for jobs but not finding any.

While there is no evidence for the increase in skilling claims, there is evidence and data on the number of people currently employed and working. The PLFS includes something called a labour force participation rate. The participation reports out participation, i.e. what is the proportion of people who actually work? The data tells us that this has fallen by almost four percentage points over a five-year period.

People stop participating in the workforce when they stop looking for work. This most commonly happens when they cannot find work. This is called unemployment. Sometimes people cannot find appropriate work (work comensurate with skills or academic qualifications) which is called underemployment.

What can be done about India’s situation - unemployment per se and then our stagflationary status? For any problem as complex as these, the solutions have to be comprehensive and wide-ranging, a tweak or two isn’t going to cut it. The real answer, sadly, is not more policy making. Instead it is actual supply-side improvements in productivity. As much as I sound like a broken tape-recorder, agricultural productivity, educational productivity and improved healthcare outcomes are at the center of the solution.

Economics is full of obvious little nuggets of knowledge, such as the idea of there being ‘no such thing as a free lunch’. This aphorism is currently the most likely truth of India’s economy .

Write a comment ...