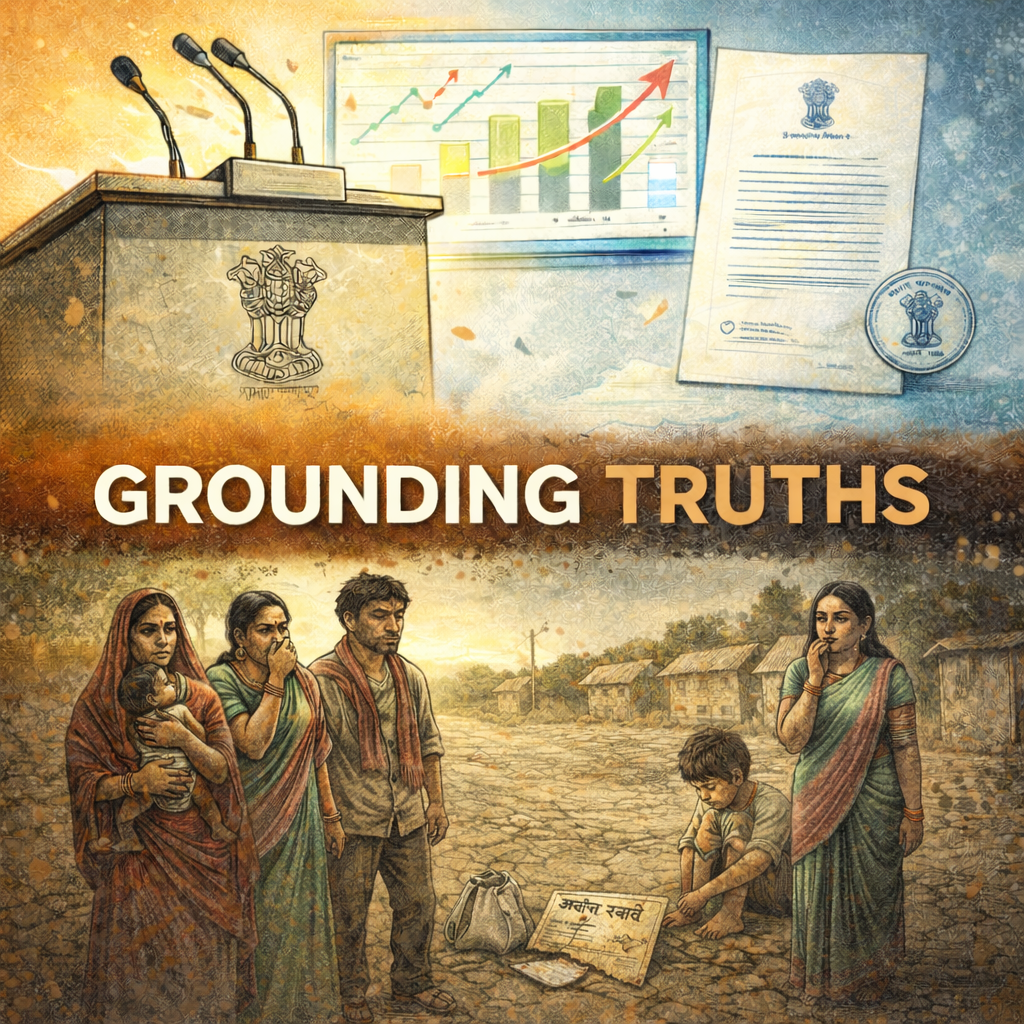

Cesses, surcharges, and a broken GST promise have systematically drained states while burdening the people the reforms were supposed to help.

I pay taxes in Delhi. Like most middle-class Indians, I don't think much about where those taxes go—the deductions happen automatically, the GST gets added to every bill, and life moves on. But recently I've been trying to understand a puzzle: if India's tax collections have been growing at record rates, why does my state government seem perpetually broke? Why are teachers unpaid, hospitals understaffed, and roads unrepaired?

The answer, it turns out, lies in one of the most consequential but least discussed policy shifts of the past decade. While the BJP government has spent ten years talking about "cooperative federalism," it has been quietly engineering the most dramatic centralisation of fiscal resources since Independence. The mechanisms are technical enough to escape public attention—processes and cesses that bypass revenue sharing, formula changes that penalise successful states, a GST architecture that promised simplification but delivered complexity.

The result is a systematic transfer of resources from states to Centre, from South to North, from the people who generate wealth to a government that increasingly hoards it.

This essay is about that heist. It's about how the federal fiscal compact that held India together for seven decades has been hollowed out, and what that means for the nurse in Kerala whose salary is delayed, the small trader in Surat drowning in GST returns, and the consumer who was promised lower prices but got higher ones instead.

The Cess and Surcharge Explosion

Here's a figure that should make every Indian think: in 2011-12, cesses and surcharges accounted for 10.4% of the Centre's gross tax revenue. By 2021-22, that figure had nearly tripled to 28.1%. In absolute terms, collections jumped from around ₹90,000 crore to over ₹6.95 lakh crore in 2022-23.

Why does this matter? Because cesses and surcharges are not shared with states.

Article 270 of the Constitution mandates that the Centre share a portion of its tax revenues with states—currently 41% as recommended by the 15th Finance Commission. But cesses levied for "specific purposes" are explicitly excluded from this divisible pool. Every rupee raised through a cess is a rupee the Centre keeps entirely for itself.

The genius—if you can call institutional subversion genius—is that this is perfectly legal. The Constitution allows it. What the Constitution's framers didn't anticipate was a government that would exploit this loophole to effectively rewrite the revenue-sharing formula without amending a single law.

The major cesses now operational tell their own story: GST Compensation Cess (₹1.45 lakh crore annually), Health and Education Cess (₹71,000 crore), Agriculture Infrastructure Development Cess (₹74,000-81,000 crore), Road and Infrastructure Cess, Income Tax Surcharges. Each one sounds reasonable in isolation. Together, they constitute a parallel tax system that has shrunk the divisible pool from 89.8% of gross tax revenue in 2011-12 to just 71.6% by 2020-21.

The 15th Finance Commission acknowledged this bluntly: "The divisible pool as a percentage of the gross revenues of the Union has been consistently falling as more and more resources are raised through non-shareable cesses and surcharges."

And here's the kicker: the money often doesn't even go where it's supposed to. The CAG's Report No. 4 of 2020 found that of ₹2,74,592 crore collected from 35 cesses in 2018-19, only ₹1,64,322 crore—60%—was actually transferred to designated reserve funds. Over ₹1.1 lakh crore simply stayed in the Consolidated Fund of India, available for whatever the Centre wanted.

The most egregious case: ₹1,24,399 crore in Cess on Crude Oil collected over a decade was never transferred to the Oil Industry Development Board. Not a single rupee. The CAG concluded, with bureaucratic understatement, that "failure of the Ministry of Finance to create/operate basic Reserve Funds makes it difficult to ensure that the cesses etc., had been utilised for the specific purposes intended by the Parliament."

Karnataka's Revenue Minister Krishna Byre Gowda put it more directly: although ₹30,000-40,000 crore is collected in Karnataka alone as cess on petrol and diesel, the state receives barely ₹1,000 crore annually. The state government estimates that it has lost ₹53,359 crore between 2017-18 and 2024-25 due to non-sharing of cesses and surcharges.

The Devolution That Wasn't

Even the money that does get shared doesn't reach states fairly.

The 14th Finance Commission, chaired by former RBI Governor Y.V. Reddy, made a historic decision in 2015: increase the states' share of central taxes from 32% to 42%—a ten-percentage-point jump that represented genuine fiscal decentralisation. There are credible reports that Prime Minister Modi wanted to keep devolution at 33%; Reddy reportedly refused to budge.

The 15th Finance Commission, operating under different political constraints, reduced the share to 41%—ostensibly to accommodate the newly created Union Territories of Jammu & Kashmir and Ladakh. But the real erosion happened through the cess mechanism described above. The effective share states actually receive is closer to 30-32% of gross tax revenue, not the 41% in the headlines.

A NIPFP study calculated that states would need 48.94% devolution to eliminate the "vertical fiscal imbalance"—the gap between what states raise and what they spend. States generate approximately 38% of total government revenue but shoulder 61-62% of expenditure. They run schools, hospitals, police forces, irrigation systems. The Centre runs the military and collects most of the taxes. This imbalance is structural; the Finance Commission mechanism is supposed to correct it. Instead, under the current dispensation, it's been allowed to widen.

The horizontal distribution—how money is divided among states—has become equally contentious. The shift from 1971 census population data to 2011 census data, combined with formula changes, has systematically penalised states that successfully reduced fertility rates.

The losses are stark. Karnataka's share of central taxes fell from 4.713% under the 14th Finance Commission to 3.647% under the 15th—a drop of 1.066 percentage points representing an estimated ₹9,000-11,000 crore annually. Kerala dropped from 2.500% to 1.925%, losing 0.575 percentage points. Telangana fell from 2.437% to 2.102%, losing 0.335 percentage points. Only Tamil Nadu barely held steady, inching from 4.023% to 4.079%.

The combined share of southern states fell from 18.62% to 15.8%—a decline of nearly three percentage points representing tens of thousands of crores annually. The bitter irony is that states that adhered to national population policies and invested in women's Education are now being punished for their success. In contrast, states that failed to control population growth are rewarded with larger shares.

The 15th FC introduced a "Demographic Performance" criterion with 12.5% weightage, supposedly to address this. But the formula multiplies demographic performance by the 1971 population, ensuring that larger states still benefit. The result: Bihar scores higher than Kerala on "demographic performance" despite Kerala having far lower fertility rates.

January 2025: The Number That Says It All

In January 2025, the Centre released ₹1,73,030 crore in tax devolution to states. The distribution:

Uttar Pradesh received ₹31,039 crore. Bihar got ₹17,318 crore. Madhya Pradesh received ₹13,696 crore. West Bengal got ₹12,981 crore. All five southern states—Karnataka, Tamil Nadu, Kerala, Andhra Pradesh, and Telangana—received approximately ₹27,500 crore, less than UP alone.

Uttar Pradesh—which accounts for 2.3% of India's direct taxes—received more than the combined total of Karnataka, Tamil Nadu, Kerala, Andhra Pradesh, and Telangana. Those five southern states account for over 25% of direct tax collections and approximately 28.5% of GST collections.

Karnataka receives 15 paise for every rupee it contributes to the Union. Tamil Nadu gets 29 paise. Bihar? Over ₹7 for every rupee.

I understand the argument for redistribution. Poorer states need more resources. The principle of horizontal equity—reducing regional disparities—is constitutionally sound. But there's a difference between redistribution and extraction. When the contributing states are themselves facing fiscal crises, when their public services are deteriorating, and when they're being forced to borrow at market rates. In contrast, their own tax money flows elsewhere—that's not redistribution. That's a protection racket.

The GST Compensation Betrayal

The Goods and Services Tax, implemented in July 2017, was sold as India's most significant tax reform since Independence. States surrendered their most important revenue sources—VAT, entry tax, entertainment tax, octroi—in exchange for a guarantee: 14% annual revenue growth for five years, with any shortfall covered by a compensation cess on luxury and sin goods.

For two years, the system worked. Cess collections exceeded compensation requirements. Then came 2019-20, when GST revenues began falling short of projections. Then came COVID-19.

At the 41st GST Council meeting in August 2020, Finance Minister Nirmala Sitharaman presented what she called an "Act of God" situation. The compensation shortfall for 2020-21 was estimated at ₹2.35 lakh crore. The cess fund had perhaps ₹65,000 crore. The Centre's solution: states could borrow the money themselves.

The government offered two options, both involving state borrowing, with a crucial distinction between "GST implementation shortfall" (which the Centre would help repay through future cess collections) and "COVID impact shortfall" (which states would bear alone). The message was clear: the guarantee you surrendered your fiscal autonomy for? We're not honouring it.

Nine states—Kerala, West Bengal, Tamil Nadu, Delhi, Telangana, Chhattisgarh, Punjab, Rajasthan, and Puducherry—refused both options. Kerala Finance Minister Thomas Isaac declared, "This facade has to stop. We will not back down. If it is not settled here, we'll go to court. Let the states of India go and file a case in the Supreme Court against the central government. This is a bad day for India and Indian federalism."

The threat worked, partially. The Centre eventually agreed to borrow ₹2.69 lakh crore as "back-to-back loans" to states—technically Centre borrowing, practically state liability. The compensation mechanism formally ended on 30 June 2022. The cess continues until March 2026, but exclusively to repay those loans—not to provide fresh compensation.

At the 47th GST Council meeting, 12 states demanded continuation of compensation beyond 2022. Only 5 of 31 states and UTs had achieved the 14% protected revenue growth rate organically—Arunachal Pradesh, Manipur, Mizoram, Nagaland, and Sikkim, all tiny northeastern states. Every major state had failed to hit the target. The Centre's response? States should "stand on their own feet and not depend on compensation."

The states that surrendered their fiscal sovereignty in 2017 on the promise of guaranteed revenue growth found themselves, five years later, with neither sovereignty nor guarantees.

The Ground-Level Nightmare

But the fiscal squeeze on states is only half the story. GST was also supposed to benefit ordinary Indians through simplification for businesses and lower prices for consumers.

On both counts, it has failed spectacularly.

The Small Business Compliance Trap

Consider the life of a small trader in Surat, or a fabric manufacturer in Tirupur, or a handicrafts exporter in Jaipur. Before GST, they dealt with one state VAT department. Now they navigate a system requiring 25-37 returns annually: monthly GSTR-1 (sales details, due by 11th), monthly GSTR-3B (summary with payment, due by 20th), and for those above ₹2 crore turnover, annual GSTR-9. Miss a deadline? Late fees of ₹50 per day plus 18% interest.

A NIPFP survey of 157 MSMEs found that 82% faced increased compliance costs, with first-time taxpayers particularly struggling with the Input Tax Credit mechanism. 59% reported that working capital was blocked because they had to pay GST on inputs before receiving payment from customers. Twenty-one per cent were trapped in inverted duty structures in which raw materials are taxed at a higher rate than finished goods, resulting in accumulated credits that cannot be used.

The Composition Scheme—meant to simplify life for small businesses—is available only to those below ₹1.5 crore turnover, excludes most service providers, bars interstate sales, and prohibits claiming Input Tax Credit. For most MSMEs operating in integrated supply chains, it's commercially unviable.

The working capital crunch deserves emphasis. Under GST, you pay tax when you buy inputs. You claim credit when you sell and file returns. But your customer pays you 45-90 days later. For small businesses operating on thin margins, this timing mismatch is devastating. The SIDBI Survey of May 2025 found that the MSME sector has a ₹30 lakh crore addressable credit gap—24% of total credit needs unmet. GST compliance burden is a significant contributor.

Freelancers: Taxed Like Corporations, Supported Like Nobody

If you're a freelance designer, writer, consultant, or developer earning above ₹20 lakh annually (₹10 lakh in special category states), you must register for GST. Your tax rate? 18% on most services. The Composition Scheme's lower rates? Not available to service providers except in minimal circumstances.

It gets worse. If you use foreign digital services—Canva for design, Zoom for calls, Adobe for editing, AWS for hosting—you're liable under the Reverse Charge Mechanism to pay GST on those services yourself. If you provide "Online Information Database Access and Retrieval" (OIDAR) services, you must register regardless of turnover.

The compliance burden is identical to that faced by large corporations: 25+ returns annually, detailed documentation, professional accounting support that costs more than many freelancers' monthly earnings. A graphic designer earning ₹25 lakh a year—solidly middle class—faces the same GST architecture as TCS or Infosys.

Sector Casualties

The textile and handloom sector employs 35.22 lakh workers, 72% of them women, with 67% earning less than ₹5,000 per month. The inverted duty structure—yarn taxed at 18%, fabric at 5%—creates an accumulated Input Tax Credit that small weavers cannot recover. Nearly 1,000 artisans wrote to the Finance Minister in August 2025, demanding the complete removal of GST.

The handicrafts sector saw ₹3,500 crore in GST refunds blocked in the first months after implementation, with the Jodhpur Handicrafts Exporters' Association reporting ₹450 crore pending and sales reduced by 50%. A survey found that 90% of artisans were unaware of the refund process, and 75% didn't know their applicable tax rates.

The gems and jewellery sector, with its 3% GST rate, faces overlapping regulations from the DGFT, Customs, GST, and RBI, as well as state-specific e-way bill requirements that small artisanal units cannot navigate.

These aren't abstract compliance problems. Their livelihoods were destroyed, their traditions abandoned, and their children pulled out of school because their parents' small business couldn't survive the paperwork.

The "GST Bachat" Joke

Remember the promise? Elimination of cascading taxes would reduce consumer prices. The RBI estimated a 10-basis-point impact on inflation. "GST Bachat"—GST savings—was the slogan.

A NIPFP study using Bayesian causal inference found the opposite: GST increased headline CPI inflation by 1.37 percentage points. Housing costs rose by 1.99 percentage points relative to what they would have been without GST. Miscellaneous services rose 2.14 percentage points. The only category that saw a genuine decline was exempted food items.

Category Impact on Inflation Headline CPI +1.37 pp Housing +1.99 pp Miscellaneous +2.14 pp Clothing & Footwear +0.72 pp Non-exempted F&B -4.42 pp

The study's crucial finding is that "Market structure determines whether GST benefits are passed to consumers." In competitive sectors such as food products, prices declined. In concentrated sectors—clothing, footwear, tobacco, real estate—firms simply pocketed the tax reduction.

This wasn't supposed to happen. Section 171 of the CGST Act established the National Anti-Profiteering Authority in November 2017, specifically to ensure businesses passed GST benefits to consumers. The NAA detected ₹600 crore in profiteering and issued orders against major companies: Hindustan Unilever (₹383 crore), Jubilant Foodworks/Domino's (₹41 crore for keeping pizza prices unchanged after rates dropped from 18% to 5%), Patanjali (₹75 crore), Nestle (₹90 crore).

In December 2022, the NAA was dissolved, and its functions were transferred to the Competition Commission of India. The CCI promptly declared anti-profiteering "not its core function." Between December 2022 and June 2024, CCI closed only 27 cases, while 140 remained pending, and 184 were pending in the High Courts. The function was transferred again to the GST Appellate Tribunal in October 2024, with a sunset clause that ended the acceptance of new complaints on 1 April 2025.

The architecture for consumer protection was dismantled before it could work. By late 2025, 3,169 complaints of non-price reductions had been received since the "GST Bachat Utsav 2.0" campaign—most of which were forwarded to nodal officers without enforcement authority.

The CAG had warned, based on VAT experience: "Dealers did not pass benefits of tax reduction to consumers." Nobody listened. The pattern repeated. Consumers paid more; businesses kept the difference; the enforcement mechanism was designed to fail.

The Political Economy of Extraction

Why does this happen? Why would any government systematically undermine its own federal structure?

The answer lies in electoral mathematics. The BJP's path to power runs through the Hindi heartland—Uttar Pradesh, Bihar, Madhya Pradesh, and Rajasthan. These states are net recipients of fiscal transfers. The states that contribute disproportionately—Maharashtra, Karnataka, Tamil Nadu, Gujarat, and Kerala—include several in which the BJP either doesn't govern or faces strong opposition.

A fiscal system that transfers funds from Karnataka to UP is, from a purely electoral perspective, rational. Karnataka's 28 Lok Sabha seats matter less than UP's 80. Tamil Nadu's 39 seats are mainly out of reach. The political incentive is to maximise transfers to states where votes can be won, funded by states where they can't.

The southern states understand this perfectly. Karnataka CM Siddaramaiah submitted to the 16th Finance Commission demanding 50% vertical devolution, a 5% cap on cesses and surcharges, and return of 60% of the state's contribution. Kerala has filed an Article 131 suit in the Supreme Court challenging the Centre's Net Borrowing Ceiling limits. Tamil Nadu's Finance Minister states plainly: "When we pay ₹1 to the Government of India, the Union government devolves only 29 paise."

The 16th Finance Commission, chaired by former NITI Aayog Vice-Chairman Arvind Panagariya, has received submissions from 22-23 states demanding 50% devolution. Panagariya has indicated this is "too large a jump." The Commission will likely maintain the 41% rate while states continue to be squeezed through the cess mechanism the Commission cannot touch.

The Cracks in the Compact

India's fiscal federalism was never perfectly balanced. But it rested on a consensus: richer states would subsidise poorer ones in exchange for national unity, and the Centre would play the role of honest broker. That consensus is fracturing.

When economist Rathin Roy observes that "when Uttar Pradesh is poorer than Nepal and Tamil Nadu almost as rich as Indonesia... the more difficult it is to convince people that the tax base should be viewed as a single entity," he's describing a structural tension that policy can no longer paper over.

The southern states face a demographic time bomb that makes fiscal extraction particularly cruel. Kerala's elderly population is projected to reach 20.9% by 2031, Tamil Nadu's 18.2%, and Karnataka's 15%. These states need more resources for healthcare and pensions precisely as their shares of central transfers shrink. The formula that rewards population growth punishes individuals for ageing.

Former RBI Governor Y.V. Reddy's co-authored book Indian Fiscal Federalism (OUP, 2019) examines how "momentous events since 2014" have altered the federal balance. Vijay Kelkar, who chaired the 13th Finance Commission, warned in a NIPFP working paper about "widening inequity between states," breaking the basis for "fraternal consensus."

West Bengal claims more than ₹1 lakh crore in outstanding dues for centrally sponsored schemes, including ₹51,627 crore in pending MGNREGA dues. When CM Mamata Banerjee publicly tore up new MGNREGA operational guidelines in December 2024, calling them a "valueless and insulting diktat," she was performing a rupture that had been building for a decade.

What Would It Take?

The reforms needed are clear enough. Raise vertical devolution to 50%. Cap cesses and surcharges at 5% of gross tax revenue, with anything above included in the divisible pool. Revise horizontal formulas to reward the demographic transition rather than penalise it. Simplify GST for small businesses—raise exemption thresholds, reduce return frequency, and fix the ITC mechanism that has been broken for seven years.

None of this will happen voluntarily. The Centre benefits too much from the current arrangement. The states that would gain lack the parliamentary numbers to force change. The Supreme Court has been reluctant to intervene in matters it deems political questions.

What might force change is the growing recognition that fiscal extraction is becoming politically unsustainable. When Karnataka legislators protest at Jantar Mantar, when Kerala invokes Article 131, when Tamil Nadu moves the Supreme Court over withheld Education funds, when southern Chief Ministers form coalitions and issue joint statements—these are symptoms of a federal compact under severe stress.

The NDA government's White Paper of February 2024 claimed transfers were 3.8 times higher than under the UPA. The comparison is misleading—it ignores the tripling of cesses that shrunk the divisible pool, the formula changes that redirected horizontal transfers, and the broken GST compensation promise. But the defensiveness suggests the government knows its record is vulnerable.

The Bill Comes Due

I began by asking why my state government appears insolvent despite record tax collections. The answer is that the money I pay doesn't stay where I live, doesn't fund the schools my children attend or the hospitals I might need. It flows upward to a Centre that keeps an ever-larger share for itself, and outward to states whose votes matter more than mine.

This is not an argument against redistribution. It's an argument against dishonesty—against a government that talks about cooperative federalism while practising fiscal colonialism and promising GST savings. At the same time, prices rise, which guarantees compensation while breaking its word, which lauds small business while drowning entrepreneurs in paperwork.

The small trader filing her 25th GST return of the year, the freelancer paying 18% tax without corporate support systems, the Karnataka taxpayer receiving 15 paise back on every rupee contributed, the consumer still waiting for prices to fall—they are all paying for a system designed to extract maximum revenue with minimum accountability.

The question is how long they'll keep paying.

Further reading:

NIPFP Study: "Enhanced Devolution and Fiscal Space at the State Level" (2024)

Y.V. Reddy and G.R. Reddy, Indian Fiscal Federalism (Oxford University Press, 2019)

Write a comment ...