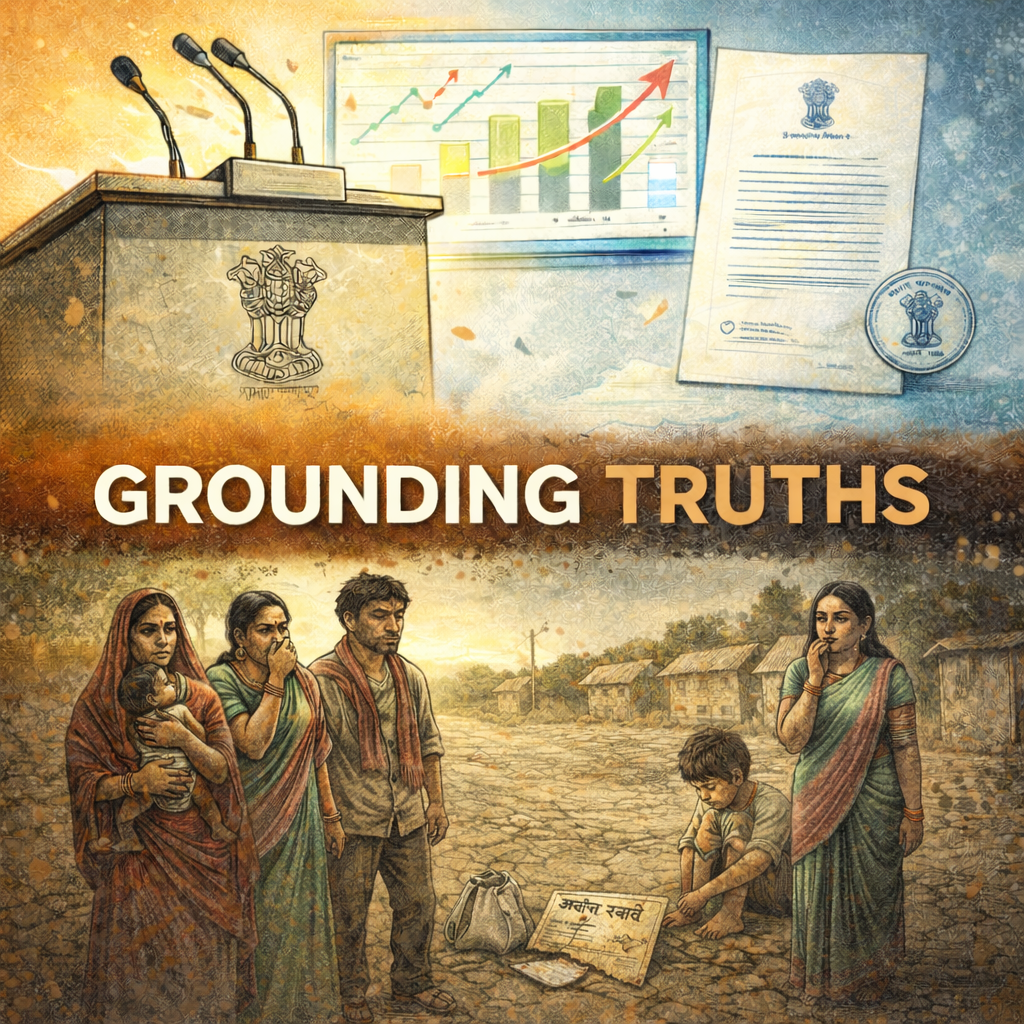

A century after Ambedkar argued that the rupee's instability hurt India's peasants more than its merchants, we're still debating who pays when our currency loses value.

My uncle in Hyderabad checks the exchange rate every morning. He's done this for years—ever since his son moved to the US for work, ever since the monthly dollar transfer became the rhythm of his financial life. "Ninety rupees," he told me last month, his voice mixing satisfaction with something like wonder. "When he first left, it was sixty-three." The same dollars now buy nearly half again as many rupees. For him, the falling rupee is a windfall.

But I check the exchange rate too, and for me it's a different story. I watch the numbers with the anxiety of someone whose cooking oil, whose children's imported electronics, and whose fertiliser-dependent vegetables all cost a little more each month. In November 2025, the rupee crossed 90 to the dollar for the first time. By early December, it reached an intraday low of 91.07—the worst performer in Asia this year, down over 5% against the dollar since January.

The headlines label this a "depreciation," a neutral-sounding term that obscures who gains and who loses when a currency depreciates. The government's spokespersons mention it briefly, then pivot quickly to discussing "competitive exports." The RBI intervenes by selling dollars and watches its foreign exchange reserves decline from a record $704.9 billion in September 2024 to $624 billion by January 2025. And ordinary households—the ones buying cooking oil, fertiliser-dependent food, imported electronics—pay prices that inch upward in that steady, annoying way that never quite makes news.

This essay examines what happens when the rupee depreciates. It's about a debate that's a century old—one that B.R. Ambedkar engaged with as a young economist in 1923—and yet remains fundamentally unresolved. Who does a "weak" rupee benefit? Who does it hurt? And why has India, after seven decades of independence, not been able to build the structural conditions that would make the answer less painful?

Ambedkar's Rupee: A Forgotten Foundation

Before Ambedkar drafted the Constitution, before he became a symbol of Dalit liberation, he was an economist. His 1923 doctoral thesis at the London School of Economics—The Problem of the Rupee: Its Origin and Its Solution—remains one of the most sophisticated analyses of Indian currency ever written. It is also largely forgotten in contemporary debates.

Ambedkar's intervention came at a moment of imperial controversy. The British had maintained India on a silver standard when the global price of silver was collapsing, creating wild fluctuations in the rupee's value. The colonial government's solution—the gold exchange standard, championed by John Maynard Keynes—pegged the rupee to sterling while keeping actual gold out of Indian hands. Ambedkar dissented. He argued for a full gold standard and, more radically, proposed a central monetary authority to manage India's currency—an idea that would eventually inform the Reserve Bank of India Act of 1934.

But Ambedkar's more profound insight was political-economic. He understood that currency isn't merely a technical matter—it's "the focusing point of all human efforts, interests, desires, and ambitions." When the rupee fluctuated, it wasn't abstract: peasants who sold their crops at harvest faced unpredictable prices; workers whose wages were nominally fixed found their purchasing power eroding; merchants who dealt in imports and exports could hedge and profit. The distribution of currency risk, Ambedkar saw, tracked the distribution of power.

His central argument remains piercing: "Nothing will stabilise the rupee unless we stabilise its general purchasing power." Exchange rate stability, he insisted, was meaningless without price stability—and price stability required looking at what working people could actually buy with their wages, not just what the rupee fetched in London.

A century later, we're still debating the same question in different language: Should India defend the rupee's exchange rate, or let it "find its level"? The answer depends entirely on whom you're trying to protect.

A History of Falling: 1966, 1991, 2013, 2025

India has had three major currency crises since independence, and we may be in the slow-motion unfolding of a fourth.

1966 was a catastrophe. The rupee, which had traded at 4.76 to the dollar, was devalued by 57% to 7.50. The proximate causes were wars—with China in 1962 and with Pakistan in 1965—droughts, and depleting foreign exchange reserves. The underlying cause was a fixed exchange rate that had become unsustainable as Indian inflation outpaced global inflation.

Indira Gandhi, newly the prime minister, faced a brutal choice. The World Bank promised $900 million in aid if India devalued and liberalised. She compelled her cabinet to accept, over furious opposition from Congress's socialist wing. The devaluation happened, but the promised aid largely didn't materialise. India retreated to protectionism. The episode was remembered as a capitulation to external pressure, and it poisoned the well for market-oriented reforms for a generation.

1991 was different. The crisis was worse—forex reserves had fallen to barely three weeks of import cover, the fiscal deficit was 7.8% of GDP, and inflation was running at 14%. But the response was smarter. The rupee was devalued by 18-19% in two steps in July. Crucially, this came with genuine liberalisation—not the half-hearted, quickly-reversed measures of 1966. The managed float regime that emerged allowed the rupee to adjust gradually, and the crisis became the origin point of India's growth story.

2013 is often forgotten, but it matters. When Fed Chair Ben Bernanke merely hinted at tapering quantitative easing on May 22, 2013, the rupee fell 15-20% by late August, hitting an all-time low of ₹68.82. India was labelled one of the "Fragile Five" alongside Brazil, Turkey, Indonesia, and South Africa—countries with large current account deficits and dependence on foreign capital. The RBI's response included raising interest rates, launching the FCNR(B) scheme, which attracted $34 billion in NRI deposits, and raising customs duty on gold imports. Within months, the rupee recovered below ₹60. The lesson drawn was that gradual adjustment outperforms rigid defence—but also that India remained structurally vulnerable to shifts in global capital flows.

2025 is still unfolding. The rupee has depreciated roughly 5-6% this year against the dollar, touching historic lows above 90. The IMF has reclassified India's exchange rate regime from a "stabilised arrangement" to a "crawl-like arrangement"—a polite way of saying the RBI is allowing gradual depreciation while trying to prevent a rout.

The drivers are different from previous crises. There's no single shock, no imminent default. Instead, there's a slow squeeze: foreign portfolio investors have withdrawn approximately $29 billion from Indian equities between October 2024 and March 2025—FPI inflows collapsed from ₹1.71 lakh crore in 2023 to just ₹2,026 crore in 2024, a 99% decline. (The opacity of official economic data—something I've written about before—makes it harder to assess how much of this reflects genuine fundamentals versus sentiment-driven rotation to Chinese equities trading at lower valuations.) The dollar has strengthened globally as the Fed keeps rates higher for longer. US tariffs of 50% on Indian goods have dampened export sentiment. And India's structural vulnerabilities—above all, its oil import dependence—remain unaddressed.

The Heterodox Critique: Is RBI Overintervening?

The conventional narrative frames the rupee's fall as an external shock requiring central bank defence. But a growing chorus of economists—including former RBI Governor Duvvuri Subbarao—argues that the RBI has been intervening excessively, effectively operating a "de facto peg" rather than the officially claimed floating exchange rate.

In January 2025, Subbarao warned that "if the Reserve Bank intervenes to stabilise the exchange rate against fundamentals, market participants will outsource their risk management to the RBI." This critique has gained empirical support from economists Ila Patnaik, Radhika Pandey, and Rajeswari Sengupta, who documented in February 2025 that INR-USD volatility in 2023-24 was just 1.8%—the lowest in over two decades, even lower than when the rupee was explicitly pegged in 2000-04.

The IMF formally acknowledged this reality in late 2023, reclassifying India's currency regime. The costs of managed stability are substantial: in November 2024 alone, the RBI sold $20.23 billion in the spot market—the highest monthly intervention since 2000, exceeding even the level during the Global Financial Crisis. By that month, RBI had accumulated a $65 billion short position in the offshore NDF market, creating significant future obligations.

The alternative view, articulated by former NITI Aayog Vice Chairman Rajiv Kumar, argues that a moderately weaker, well-managed currency could serve as a "silent subsidy" for Indian producers competing with those in Bangladesh, Vietnam, and Africa. China, Japan, and South Korea, he notes, "have historically been comfortable with maintaining relatively competitive, sometimes undervalued, exchange rates."

But this export-competitiveness argument confronts a structural reality that textbook economics often ignores.

The Sectoral Paradox: When Depreciation Hurts Exporters

The textbook case for depreciation is seductive. A weaker rupee makes exports cheaper and imports more expensive, thereby improving the trade balance while boosting domestic manufacturing. This is the story the government tells.

The reality is messier, and a December 2024 Systematix Research report offers damning evidence: food and agro-based exports are the only sector where currency depreciation correlates with both increased exports and improved trade balance, owing to low import intensity. For supposedly export-competitive sectors, the picture is starkly different.

Textiles and leather—traditionally considered prime beneficiaries of a weaker rupee—are "decisively adversely impacted" by depreciation. High import costs for raw materials, dyes, and packaging, combined with competing nations' weak currencies, eliminate any pricing advantage. The workers in Tirupur and Kanpur don't benefit when the rupee falls; their factories face squeezed margins.

Pharmaceuticals present a similar paradox. India exports $27.82 billion in pharmaceuticals annually and supplies 40% of US generic drug demand—but it imports 65-70% of active pharmaceutical ingredients from China. Chinese producers have weaponised this dependency, slashing prices on 41 critical APIs by 40-50% in February 2025, targeting precisely the molecules supported by India's PLI scheme. When the rupee falls, India's pharma companies face higher costs for Chinese APIs even as they earn marginally more on US exports.

Aviation faces perhaps the most severe exposure, with 45-60% of operating expenses denominated in dollars—fuel, aircraft leases, maintenance, spare parts. A former airline CFO illustrated the impact: "If my payout is $100 for aircraft lease rentals, two years back, I paid ₹8,000. Today I pay ₹9,000 for the same aircraft." JP Morgan's sensitivity analysis found that a 1% rupee depreciation cuts airline profit before tax by 5-6%. The industry is projected to report net losses of ₹20-30 billion in FY2025-26.

Electronics imports reached over ₹7 trillion ($83 billion) in FY2024, with 70% sourced from China and Hong Kong. Semiconductor imports nearly doubled to $15.6 billion in FY2022. For automobiles, Toyota Kirloskar Motor reported that a ₹1 depreciation increases import costs by ₹90 crore annually; Maruti Suzuki imports ₹8,000 crore worth of components each year. These costs cascade through supply chains to consumers.

The uncomfortable truth is that India's export structure—with its high import intensity even in "export-oriented" sectors—means depreciation often delivers losses, not gains, to the very industries it's supposed to help.

The Geography of Depreciation: Who Wins Where

Regional disparities in currency impacts create distinct political economies across states.

Kerala stands as the clearest winner. The state receives approximately 20% of India's total remittances, constituting nearly 35% of the state's income. Total remittances surged from ₹85,092 crore in 2018 to ₹2,16,893 crore in 2023—a 155% growth driven substantially by the 16.4% rupee depreciation over this period. (I've written elsewhere about the 150-year history of Indian migration and its political economy—the same Bhojpur belt that supplied colonial plantations now supplies Gulf construction sites, and the remittance flows that cushion Kerala households are the flipside of the welfare failures that push eastern UP and Bihar to export their labour.) The average remittance per emigrant household more than doubled from ₹96,185 to ₹2,23,729. My uncle's satisfaction with the exchange rate is felt across millions of Kerala households whose relatives work in the Gulf, Europe, and North America.

Karnataka's IT corridor similarly benefits, as companies earn 50-60% of revenue from the Americas in USD while maintaining rupee-denominated costs. A 1% depreciation in the rupee yields approximately 40 basis points of margin improvement. TCS reported INR growth consistently exceeding USD growth; Infosys attributed 60 basis points of margin gains directly to currency tailwinds in recent quarters.

Gujarat presents a more complicated picture. As India's largest exporting state (accounting for 30.7% of all exports in FY2024-25), it should theoretically benefit from depreciation. Yet its textile, gems and jewellery, and ceramics sectors face margin squeeze from imported intermediates. The Morbi ceramics cluster—Asia's largest—faces both weak domestic demand and foreign exchange volatility. Only pharmaceuticals, which account for 33% of India's pharma output, emerge as net gainers due to lower import intensity relative to export volumes.

Tamil Nadu's automobile corridor exemplifies mixed impacts: automotive exports grew 25% in 2024, but component imports from Japan and South Korea have become significantly more expensive. The state's economic survey estimated that, to meet its target of becoming a $1 trillion economy by 2030, 18.95% annual growth is required merely to offset projected rupee depreciation of ₹2.36 per annum.

The currency map of India, in other words, doesn't align neatly with the export-versus-import distinction. It depends on what you export, where you source inputs, and whether your households receive dollar incomes from abroad.

The Household Burden: Inflation's Unequal Weight

The most politically important impact of rupee depreciation—and the least discussed—is its effect on household budgets.

The World Inequality Lab's 2025 working paper documents that "the volatility of inflation is higher for the poor vis-à-vis the rich households and has persistently remained higher for the poor households." Rural households allocate 50-60% of their budgets to food, whereas urban households allocate 30-40%. Food inflation accounted for 73% of headline rural inflation, compared with 56% of urban inflation, in October 2024, when retail inflation reached a 14-month high of 6.21%.

When the rupee falls, the cost of imported edible oils rises. The cost of fertiliser—and hence food—rises. The cost of LPG rises. These aren't luxuries; they're essentials that consume the largest share of poor households' budgets. And the rural safety net that might cushion these shocks is itself being dismantled—the VB-G RAM G Bill that replaces MGNREGA shifts fiscal burden to states least able to bear it, precisely when imported inflation is squeezing rural purchasing power.

RBI's November 2025 household survey reveals a persistent gap between expectations and reality: households expect 9-10% inflation, whereas the actual CPI is 4-6%. Median three-month-ahead inflation expectations stand at 7.6%, with one-year expectations at 8.0%. Retired persons and those over 60 perceive higher inflation than younger cohorts—perhaps because they remember when the rupee bought more. This perception-reality gap isn't irrational; it reflects the stagflationary dynamics where headline growth masks stagnant real incomes and persistent price pressures on essentials.

Families sending children abroad face the most dramatic cost escalation. With 1.3 million Indian students studying overseas in 2024 and the rupee having depreciated approximately 40% since 2015, education costs have risen commensurately. A $40,000 annual program that costs ₹28 lakhs at ₹70/USD now costs ₹34 lakhs at ₹85/USD. One financial planning example illustrates the impact: a family that saved ₹35 lakh in 2019 for a $50,000 education at ₹70/USD faced a ₹14.8 lakh shortfall when 2024 costs reached $60,000 at ₹83/USD. Indian student enrollments in Canada, the UK, and the US dropped 40% in 2024, with students shifting toward Germany, Russia, and France.

Corporate Hedging: The SME Disadvantage

India's external debt reached $736.3 billion by March 2025 (19.1% of GDP), with 54.2% denominated in US dollars—roughly $399 billion directly exposed to currency movements. Non-financial corporations account for 37.4% of this debt.

Large IT and pharma exporters maintain robust hedging practices, typically covering 30% of receivables for 1-2 quarters. TCS, Infosys, and HCL Technologies actively manage currency risk through forwards and options. However, SMEs face systemic disadvantages: limited access to hedging instruments, higher relative costs, and an inability to provide the information banks require.

RBI's January 2023 regulations on Unhedged Foreign Currency Exposure require banks to provision incrementally based on estimated forex losses relative to operating income. Regulations push unverified exposures into the highest-risk bucket, requiring 80 basis-point provisioning—effectively penalising smaller firms for their lack of hedging sophistication.

Fitch Ratings warned in December 2025 that sharp depreciation exceeding 10% over 6-12 months could materially affect ratings for renewables, power utilities, toll roads, and infrastructure firms lacking natural hedges through export earnings. The collapse of Suzlon Energy in 2012, which defaulted on $220 million in FCCB redemption amid a total debt of ₹14,300 crore, remains a cautionary tale.

The policy that allows the rupee to depreciate "smoothly" implicitly assumes corporations can hedge. Many can't. The costs fall disproportionately on smaller firms without treasury departments or banking relationships that enable sophisticated risk management.

Gold: The Structural Drain

India imported over $52 billion in gold during FY2024-25 (approximately 812 tonnes)—a structural drag on the current account that policy interventions have failed to address. The October 2025 record monthly gold import of $14.72 billion contributed directly to the largest-ever trade deficit of $41.68 billion. Gold accounts for over 5% of India's total imports.

Analysis shows that India's current account "looks healthier without gold"—in Q4 2024, a $22.98 billion surplus excluding gold was offset by $19.47 billion in gold imports alone.

Government policies have proved ineffective. The Sovereign Gold Bond scheme was discontinued in FY2024-25, with Finance Minister Sitharaman confirming that no further issuance would occur, citing gold prices that had surged and characterising the scheme as a "high cost method of borrowing". The Gold Monetisation Scheme was terminated in March 2025 after mobilising only 31,164 kg of gold—a fraction of the estimated 25,000 tonnes held by Indian households. The July 2024 duty cut from 15% to 6% triggered a 221% surge in August imports, contrary to expectations that it would reduce smuggling incentives.

The rupee-gold relationship is perversely reinforcing: when the rupee weakens, gold becomes more expensive domestically, but this often increases rather than decreases demand, as Indians seek to hedge against further currency erosion. Current smuggling margins have reached ₹1.15 million per kilogram—82.5% higher than post-duty-reduction levels.

Oil: The Achilles Heel

India's vulnerability to rupee depreciation cannot be understood without understanding oil.

The numbers are stark. India imported 242.4 million metric tonnes of crude oil in FY24-25, against domestic production of just 28.7 MMT. That's an import dependence of 88.2%—among the highest for any major economy. We are the world's third-largest oil consumer, and we produce almost none of what we consume.

Crude oil accounts for roughly 25% of India's merchandise imports, or approximately ₹18 lakh crore annually—nearly 3% of GDP. Every rupee of depreciation increases this bill. According to ICRA Ratings, a $ 10-per-barrel increase in oil prices would expand India's current account deficit by 0.3 percentage points of GDP. Rupee depreciation has an equivalent effect: it raises the rupee cost of each barrel imported.

The geopolitical entanglement makes this worse. Since 2022, Russia has become India's largest oil supplier—its share rising from 1.7% in 2020 to 35.1% in 2025—driven by discounted crude under Western sanctions. India imported 88 MMT from Russia in FY25. If those supplies were disrupted, India would need to replace them with more expensive crude from elsewhere, further pressuring the rupee. (I've written separately about who actually benefits when crude prices fall—the short answer is: not consumers at the pump, and not public transport users. The fiscal intermediation of oil prices means discounts rarely reach the people who need them most.)

The oil vulnerability creates a vicious cycle. Depreciation raises oil import costs; higher oil costs worsen the current account deficit; a wider deficit puts further pressure on the rupee. This is the structural trap that no government since independence has managed to escape.

The Policy Impasse

The RBI has been fighting a rearguard action. It has sold an estimated $65 billion in the spot and forward markets between October 2024 and September 2025, drawing on reserves to slow the rupee's decline. It has conducted dollar-rupee swap auctions—$5.1 billion in January 2025 and $10 billion in March 2025—to inject rupee liquidity while rebuilding reserve buffers. It cut the repo rate by 25 basis points in February 2025, the first cut in nearly five years.

None of this addresses the underlying problem. The RBI can smooth volatility; it cannot eliminate structural vulnerabilities.

The IMF, for its part, wants greater exchange rate flexibility. Its view is that heavy intervention depletes reserves, distorts corporate hedging incentives, and ultimately delays necessary adjustment. Indian authorities insist they're targeting volatility, not levels—but the IMF's reclassification to "crawl-like arrangement" suggests otherwise.

The debate over forex reserves themselves has intensified. Academic research notes that "reserves yield negligible return as compared to return on alternative investments; hence, reserve holding involves an opportunity cost" that is "significantly large in developing countries due to high interest rates." With India's 10-year government securities yielding significantly above U.S. Treasury yields, each dollar held in reserves yields substantially less than if deployed domestically. But the memory of 1991—of reserves falling to three weeks of import cover—makes any proposal to draw down reserves politically toxic.

The honest answer is that there's no good option. Let the rupee fall freely, and you get imported inflation that hits the poor hardest. Defend the rupee with reserves, and you burn through the buffer that protects against a genuine crisis. The policy space is constrained by structural weaknesses that can only be addressed over years and decades—if at all.

What Ambedkar Would Ask

Return to Ambedkar's framing. He asked: whose purchasing power are we stabilising?

The managed float regime, for all its sophistication, implicitly answers: those who hold dollar assets, those who can hedge currency risk, and those whose income rises with export revenues. Depreciation is allowed to occur slowly enough that markets adjust, portfolio investors don't panic, and the crisis doesn't become acute.

But for the household buying cooking oil, the farmer buying fertiliser, the family stretching to afford a child's education—for them, the "managed" fall of the rupee is still a fall. Their purchasing power erodes. Their budgets tighten. Their options narrow.

Ambedkar understood that currency is never neutral. It is always a choice about whose interests to prioritise. The rupee's decline in 2025 is being managed to protect financial stability and export competitiveness—but the costs are borne by those least able to bear them.

What Would It Take?

The solutions are structural, long-term, and politically difficult.

Reduce oil dependence. This has been the stated goal of every government since the 1970s oil shock. Fifty years later, we import 88% of our crude. Renewable energy is growing, but not fast enough to change the fundamental vulnerability. Electric vehicles remain a tiny fraction of the fleet. Public transport investment has lagged. The transition will take decades, and we're running out of time.

Build genuine export competitiveness. India's share of global goods exports is just 1.8%—17th in the world, far behind China's 14%. We've become the "office of the world," with services exports of $263.9 billion in FY24-25, but we haven't built the manufacturing base that would make depreciation genuinely beneficial. The PLI schemes are a start, but the results so far are modest—and the import intensity of even "Made in India" products undermines the currency advantage. The deeper problem is that India's growth model isn't generating quality employment—we're growing GDP without growing the kind of jobs that would create domestic demand and reduce import dependence.

Address gold demand. The structural drain of $50+ billion annually from gold imports—driven by inflation hedging, cultural preferences, and the lack of alternative savings instruments—perpetuates current account pressures. Financial inclusion, better rural banking, and inflation-indexed instruments might, over time, shift some of this demand, but the gold habit is deeply entrenched.

Deepen domestic capital markets. India's vulnerability to FPI outflows—the $29 billion exodus that's driving much of the current pressure—reflects the shallowness of our capital markets and the reliance on foreign capital. Expanding the base of domestic institutional investors would reduce this vulnerability.

Reverse the policy choices that got us here. The current government's approach has systematically undermined the structural reforms that might address these vulnerabilities.

Start with trade policy: since 2014, tariffs have been raised on over 3,200 tariff lines, with the simple average rising roughly 25% to reach 11.1% by 2020-21—a reversal of two decades of liberalisation. The World Bank noted in 2024 that India's import tariffs on key inputs "raise costs and undermine its participation in global value chains." The RCEP withdrawal in 2019—driven substantially by pressure from the RSS-affiliated Swadeshi Jagran Manch, which organised nationwide agitations against the deal—locked India out of the world's largest trading bloc. The government's own Vivekananda International Foundation admits that "creeping protectionism" has "adversely impacted our competitiveness." We withdrew from RCEP to protect uncompetitive industries from Chinese competition, and the result is that we import $83 billion in electronics from China annually anyway—but without the market access or supply chain integration that might have come from negotiating position.

The EV transition, which might reduce oil dependence, has been systematically undermined. FAME-II subsidies were slashed from ₹15,000/kWh to ₹10,000 in 2023, then to ₹5,000 under PM E-DRIVE in 2024—and the government has announced subsidies will end entirely after this fiscal year. EV funding declined by 37%, from $934 million in 2022 to $586 million in 2024. While China deployed state capacity to dominate global EV and battery supply chains, India deployed ideology to shield its existing automobile industry from competition. The result: we remain locked into 88% oil import dependence, and every rupee of depreciation feeds directly into our import bill.

Gold policy has been equally incoherent. The Sovereign Gold Bond scheme—which channelled household gold demand into financial instruments—was quietly discontinued in FY2024-25, labelled "high cost borrowing." The Gold Monetisation Scheme was terminated in March 2025 after mobilising a pathetic 31,164 kg against household holdings of 25,000 tonnes. Meanwhile, the July 2024 customs duty cut from 15% to 6% triggered a 221% surge in gold imports in August alone, contributing to record trade deficits.

We simultaneously abandoned the instruments that might redirect gold demand and cut the taxes that constrained imports. The $52 billion annual drain continues unabated.

The pattern is consistent: announce ambitious schemes (Make in India, Atmanirbhar Bharat, PLI), use them for political messaging, then fail to build the state capacity or policy coherence required to make them work. Raise tariffs to protect uncompetitive industries rather than pushing them to become globally competitive. Let RSS-affiliate economic nationalism drive trade policy. Reduce subsidies for technologies that might mitigate structural vulnerabilities (e.g., EVs, domestic gold instruments) while protecting the industries that perpetuate them. The result is an economy that remains as import-dependent as ever, but without the export competitiveness that might earn the dollars needed to pay for those imports.

Acknowledge the distributional question. Currency policy is not just macroeconomics; it's political economy. A falling rupee has winners and losers. Policy should explicitly address who bears the costs—through targeted support for import-dependent SMEs, through inflation-indexed transfers, through honest communication about trade-offs.

A Century On

Ambedkar wrote in 1923 that a fluctuating rupee "places the burden of adjustment on the least able to bear it." That remains true.

My uncle in Hyderabad checks the exchange rate with satisfaction; the falling rupee is a windfall for his remittance-receiving household. I check it with anxiety, watching the slow erosion of purchasing power that never quite makes news but always makes itself felt. Both of us are responding to the same number—90 rupees to the dollar—, and both of us are right about what it means for us.

The rupee will find a level. Markets will adjust. The RBI will announce its interventions. The government will talk about export competitiveness. And ordinary households will continue to absorb the cost of a currency that falls because the structures that should support it were never built.

A century after Ambedkar posed the question, we still haven't answered it: stable for whom?

Further reading:

B.R. Ambedkar, The Problem of the Rupee: Its Origin and Its Solution (P.S. King & Son, 1923)

Chinmay Tumbe and Rahul Kumar Jha, "One Nation, One Ration, Limited Interstate Traction" (SAGE Journals, 2024)

RBI Liquidity Moves and Forex Market Intervention (March 2025)

IMF Reclassification of India's Exchange Rate Regime (November 2025)

Ila Patnaik, Radhika Pandey, Rajeswari Sengupta, "RBI's costly experiments with the currency" (Ideas for India, 2025)

Related essays on this site:

Write a comment ...