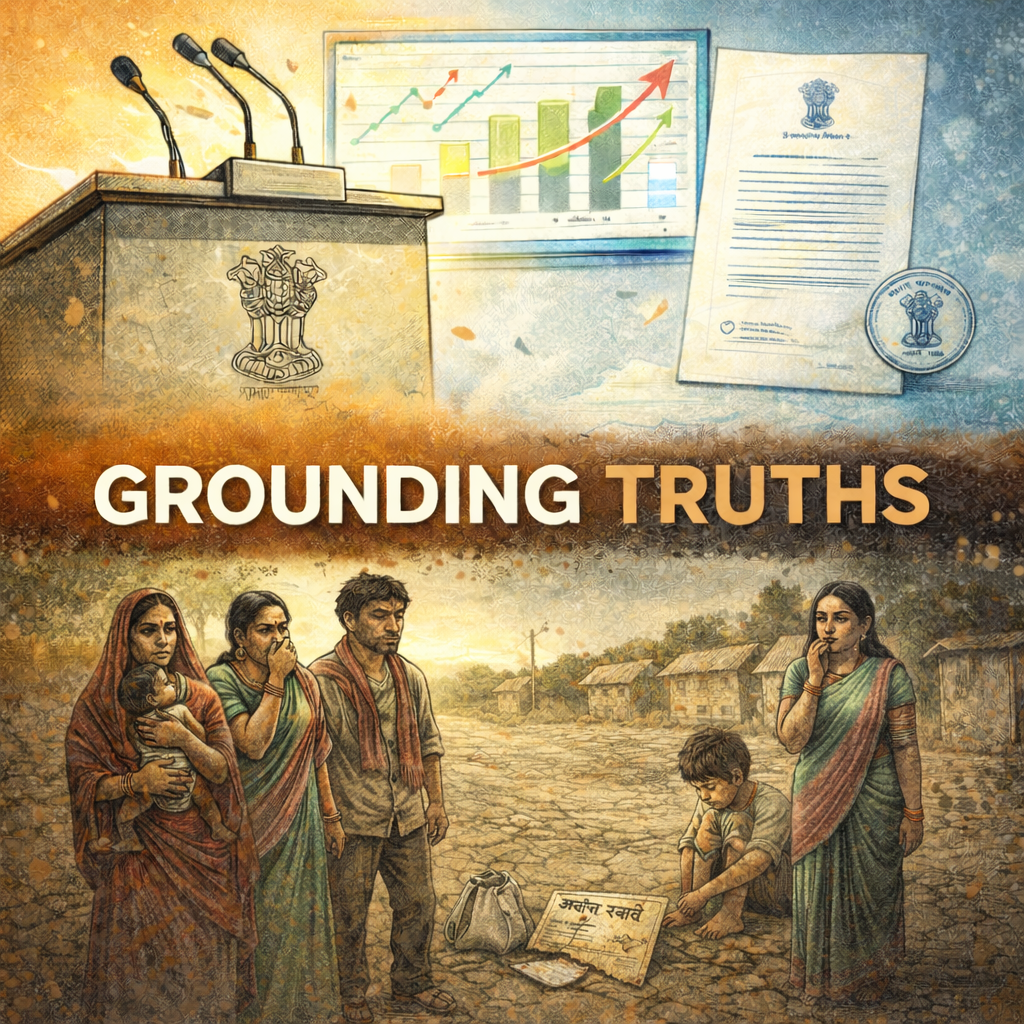

What the headlines celebrate as Modi's diplomatic win, the fine print reveals as a deal where India gives more than it gets

Last August, when the Modi government declared that India would "never compromise on the interests of its farmers, dairy farmers and fishermen" even if the Prime Minister had to "pay a very heavy price personally," it seemed like a rare moment of rhetorical clarity. Six months and a punishing tariff war later, on February 2, 2026, Donald Trump took to Truth Social to announce what he called a "trade deal" with India. The 18 percent tariff rate that followed was framed as victory. But for whom?

I have spent enough years studying the political economy of trade agreements to know that the devil lives not in the headlines but in the asymmetries. And this deal, whatever it ultimately becomes when (or if) a formal text emerges, has asymmetry written into its DNA.

The Announcement: Two Very Different Statements

What we have witnessed is not a trade deal in any technical sense. It is a political announcement with starkly different versions emanating from Washington and New Delhi.

Trump's Truth Social post claimed that Modi had agreed to stop buying Russian oil entirely, commit to purchasing over $500 billion worth of American goods across energy, technology, agriculture, and coal, and reduce India's tariffs and non-tariff barriers on US goods to "ZERO."

Modi's response on X was notably different. He confirmed only that "Made in India products will now have a reduced tariff of 18%." There was no mention of halting Russian oil purchases. No acknowledgment of the $500 billion commitment. No reference to eliminating Indian tariffs. As The Diplomat noted, Commerce Minister Piyush Goyal subsequently confirmed that "final details" were still being "worked out" and a joint statement would emerge "shortly" after "technical details" are finalised. Three days on, we still have no formal text, no joint statement, no binding document.

This is not a trade agreement. It is, at best, a confidence-building measure. At worst, it is political theatre designed to serve domestic constituencies in both countries while papering over fundamental disagreements.

The Mathematics of Asymmetry

Let us examine what the numbers actually tell us.

Under this arrangement, the US will impose 18 per cent tariffs on Indian goods. In exchange, according to Trump's claim (unconfirmed by India), India will offer zero tariffs on American products.

Trade economist Biswajit Dhar, who has worked on several Indian trade negotiations, put it bluntly: "So, the US will impose 18 per cent tariffs on India, and India is going to give them duty-free access. That is 0 versus 18. Can this be a cause for celebration on the Indian side?"

The tariff history provides essential context. Trump had initially imposed a 25 per cent "reciprocal" tariff on India in July 2025. In August, he added another 25 per cent punitive tariff specifically targeting India's Russian oil purchases, bringing the effective rate to 50 per cent. This was unprecedented: the first "secondary tariff" in Trump's trade arsenal, penalising one country for doing business with another.

The reduction to 18 per cent is relief, certainly. Indian exporters in textiles, gems and jewellery, pharmaceuticals, and engineering goods will see improved cost competitiveness. The 18 per cent rate is marginally better than Pakistan's 19 per cent or Bangladesh's and Vietnam's 20 per cent.

But here is what the celebratory coverage misses: nearly all of India's neighbours remain beneficiaries of the US Generalised System of Preferences, which facilitates duty-free entry for selected goods from developing countries. India lost GSP benefits in 2019. So while the headline rate appears competitive, the effective preferential access enjoyed by competitors remains intact.

The $500 Billion Fantasy

The $500 billion purchase commitment deserves particular scrutiny because it reveals either a fundamental misunderstanding of trade economics or deliberate political messaging intended for domestic consumption.

Current U.S. goods exports to India amount to approximately $41.5 billion annually. Add services exports of $41.8 billion, and total US exports to India reach about $83 billion. A $500 billion commitment would require a 500 per cent increase from current levels.

Put differently, as journalist T.C.A. Sharad Raghavan calculated, $500 billion amounts to roughly Rs 45.5 lakh crore. That is only marginally less than the Union government's entire budgeted expenditure of Rs 53.5 lakh crore for 2026-27. Trump's claimed promise from Modi would consume approximately 85 per cent of India's annual budget.

India's total annual merchandise imports from all countries are in the range of $700-750 billion (FY 2024-25 merchandise imports stood at $720.24 billion). A $500 billion commitment to a single country would mean the US capturing the dominant share of India's entire import basket.

Government sources have reportedly clarified that the figure is spread over five years and includes projects already in the pipeline. Even so, $100 billion annually represents a doubling of current US exports to India. The Global Trade Research Initiative concluded that such a figure "would likely require more than 20 years, suggesting this is more an aspiration than a firm commitment."

The pattern is familiar. As Helios Capital's Samir Arora observed, Trump has extracted similar headline-grabbing pledges from the EU ($600 billion), South Korea ($350 billion), and Taiwan ($250 billion). These commitments are typically structured as long-term aspirations with phased, capped implementation. The Korean deal, for instance, caps annual investments at $20 billion "to maintain financial stability."

But even soft commitments carry political weight. The promise, once made, creates expectations that must be managed and potentially entails concessions to demonstrate progress.

The Agricultural Question

Agriculture remains the most politically sensitive dimension of this arrangement, and here the gap between official statements and likely reality is widest.

US Agriculture Secretary Brooke Rollins announced on social media that the deal would help "export more American farm products to India's massive market, lifting prices and pumping cash into rural America." She noted the US agricultural trade deficit with India was $1.3 billion in 2024. The US Trade Representative, Jamieson Greer, confirmed that India had agreed to reduce tariffs on "a variety" of goods including agricultural products, specifying that tariffs on tree nuts, wine, spirits, fruits, and vegetables would go "down to zero." In earlier Senate testimony, Greer had described India as a "tough nut to crack" but said Indian offers were the "best the US has ever received."

Commerce Minister Piyush Goyal, meanwhile, has repeatedly insisted that "sensitive sectors such as agriculture and dairy have been protected."

Someone is not telling the full story.

The structural pressures are clear. The US has long sought greater market access for genetically modified crops, dairy products, and agricultural commodities. In 2024, the US agricultural trade deficit with India was $1.3 billion. Washington wants this reversed.

The implications for Indian farmers deserve serious attention. Samyukt Kisan Morcha (SKM), the federation of farmer unions that forced Modi to withdraw the three farm laws in 2021, has called this deal a "historic betrayal." They specifically identified threats to soybeans, corn, cotton, dairy, and poultry farmers.

The economic logic is straightforward. American agricultural products are heavily subsidised. US corn at roughly ₹17 per kg cannot compete fairly with Indian farmers receiving ₹24 MSP. Zero or reduced tariffs would enable dumping, putting downward pressure on domestic prices and threatening the livelihoods of the roughly 600 million Indians who still depend on agriculture.

The Centre of Indian Trade Unions warned that the deal "will severely hit Indian industries and the workers employed in them." The All-India Kisan Sabha demanded that the full text be placed before Parliament.

This is not abstract. The 2020-21 farmers' protests represented the most sustained challenge to Modi's authority since he took office. Opening agriculture to American competition would reignite rural discontent precisely when the BJP has already lost significant rural support in the 2024 Lok Sabha elections.

The Russian Oil Commitment: Geopolitics by Other Means

Perhaps no element of this arrangement is more consequential, or more unclear, than the commitment to Russian oil.

Trump has claimed India agreed to "stop buying Russian oil" entirely. The Kremlin, for its part, confirmed it has "not received any information from New Delhi about its plans to stop buying Russian oil."

The numbers reveal the scale of what is being asked. India imports approximately 1.5 million barrels per day of Russian crude, accounting for more than a third of its total imports. India is the world's third-largest oil consumer, importing approximately 88 per cent of its needs. Replacing Russian supplies is not merely a policy choice; it is an engineering and logistical challenge.

Russian oil has traded at significant discounts to global benchmarks, providing meaningful savings for Indian refiners and, by extension, Indian consumers. Moody's has warned that an immediate halt to Russian imports could disrupt economic growth and have inflationary implications.

The alternative sources Trump has identified, primarily US and Venezuelan crude, carry their own complications. American crude is expensive to transport across the Atlantic. Venezuelan oil infrastructure requires modernisation costing "tens or hundreds of billions of dollars," as Carnegie's Evan Feigenbaum noted.

India had already begun diversifying away from Russian supplies, partly due to US sanctions on Russian companies Rosneft and Lukoil imposed in October 2025. The share of US crude in India's oil imports rose to about 8.1 percent between April and December 2025, up from 4-5 percent previously. Russian volumes fell from a peak of roughly 2 million barrels per day to approximately 1.2 million by December 2025.

The question is not whether India will reduce its purchases of Russian oil; that process was already underway. The question is whether India will publicly commit to a complete halt, thereby surrendering the strategic autonomy that has characterised its foreign policy.

As Feigenbaum observed, maintaining the "symbolic hedge" that India can purchase Russian oil if it chooses speaks to both foreign policy autonomy and the ability to resist American coercion. Both matter enormously in Indian domestic politics.

The Transparency Deficit

Beyond the substantive concerns lies a fundamental problem of process.

The opposition has demanded that the Modi government brief Parliament on both the US and EU trade agreements. Congress leader Jairam Ramesh noted that more than a day after Trump's announcement, no official details had been shared publicly. "Spin doctors are at work," he wrote on X, "but we still don't have any details on the deal."

The sequencing of announcements itself raised questions. Why did Trump announce first? Why has India not released any formal documentation? If a trade deal has been concluded, where is the text?

As analyst Kallol Bhattacharya noted, trade agreements between sovereign states require clarity, sequencing, and formal texts. The announcement compared unfavourably with India's recent negotiations with the European Union, where the EU described the concluded deal as the "mother of all deals" and officials on both sides repeatedly clarified that negotiations had concluded but that agreements had not yet been signed. "If a trade deal has been done, where is the text?"

Parliament was adjourned amid opposition disruptions over the trade deal, alongside demands related to the suspension of eight opposition MPs and other contested matters. These are not unreasonable demands. Trade agreements have long-term structural consequences. They deserve legislative scrutiny.

What This Means for Development

From a development economics perspective, this arrangement crystallises several concerning trends.

First, it represents a form of what we might call "transactional multilateralism," where geopolitical leverage replaces rules-based trade negotiation. The tariff escalation of 2025, the punitive secondary tariffs, and the subsequent relief were not about trade economics. They were about compelling India to serve American strategic objectives regarding Russia. Trade policy has become foreign policy by other means.

Second, the asymmetry is structural rather than incidental. India faces 18 per cent tariffs, while it potentially offers zero tariffs; India restricts Russian oil purchases to secure tariff relief, whereas China, the largest importer of Russian energy, faces no similar penalty. The rules appear to vary according to bilateral relationships rather than to consistent principles.

Third, the lack of binding text and formal mechanisms creates uncertainty that, in itself, imposes economic costs. Business planning requires predictability. The whiplash of tariff changes, from 25 per cent to 50 per cent to 18 per cent within six months, makes long-term investment decisions difficult. As Mark Linscott of the Atlantic Council observed, even with this announcement, "more needs to be done to insulate the relationship and ensure there is enough resiliency to withstand future challenges."

Fourth, the potential opening of agriculture without adequate safeguards could accelerate rural distress. India's farm sector employs 46 per cent of the workforce but accounts for less than 17 per cent of GDP. It is characterised by small holdings, inadequate infrastructure, and chronic underinvestment. Exposing this sector to competition from heavily subsidised American agribusiness without transitional support or safety nets would be structurally regressive.

The Political Calculus

Understanding this arrangement requires acknowledging the political pressures on both governments.

For Trump, the deal delivers a headline: India, a major purchaser of Russian oil, agrees to stop. It demonstrates that tariff pressure works. It provides American farmers and energy producers with a massive new market, at least rhetorically. Whether the details work out is a problem for later.

For Modi, the calculus is more complex. The 50 per cent tariff rate was devastating for Indian exporters. The Nifty had fallen sharply; foreign investors had fled. Indian markets in 2025 suffered their worst relative performance in 30 years among emerging nations. Relief was politically necessary.

But the price may prove substantial. Rural constituencies that already shifted away from the BJP in 2024 are watching agricultural commitments closely. The rhetorical promise to "never compromise" on farmers looks hollow if American corn and dairy start displacing domestic producers. The "Atmanirbhar Bharat" slogan loses credibility if India openly commits to "Buy American" policies.

The geopolitical implications extend beyond trade. India's relationship with Russia, built over decades of defence cooperation and diplomatic alignment, cannot be casually discarded without consequences for military supply chains and regional strategic equations.

Conclusion: Caution, Not Celebration

The Global Trade Research Initiative's assessment deserves repetition: "Until there is a joint statement, negotiated text, and clarity on enforcement, this should be seen as a political signal, not a final deal. Caution, not celebration, is needed."

We have a framework of intentions, not a binding agreement. What we have is relief from punitive tariffs, not a restoration of pre-2025 conditions. What we have is a political announcement designed for domestic audiences in both countries, not a carefully negotiated trade pact that protects Indian interests. The real negotiations lie ahead. They will determine whether Indian agriculture faces dumping. Whether Indian consumers pay more for energy. Whether Indian foreign policy autonomy survives American pressure. Whether parliamentary oversight applies to trade commitments. Whether the structural asymmetries embedded in this announcement become permanent features of the bilateral relationship.

Those negotiations will happen largely outside public view, their outcomes revealed only after commitments are made. This is precisely why transparency matters now, why parliamentary scrutiny matters now, and why the demand for the full text matters now.

The government that promised farmers it would never compromise has some explaining to do.

UPDATES:

Update (February 7, 2026): The White House released the official Joint Statement on 6 February. What it reveals is clarifying, if not comforting.

First, the terminology: this is a "framework for an Interim Agreement," not a trade deal. The actual Bilateral Trade Agreement remains a future aspiration. We have moved from a political announcement to a documented framework, but this is not a binding pact.

Second, the agricultural opening is now explicit. The statement commits India to "eliminate or reduce tariffs on all U.S. industrial goods and a wide range of U.S. food and agricultural products, including dried distillers' grains (DDGs), red sorghum for animal feed, tree nuts, fresh and processed fruit, soybean oil, wine and spirits, and additional products." It further commits India to "address long-standing non-tariff barriers to the trade in U.S. food and agricultural products." This is difficult to reconcile with Commerce Minister Goyal's repeated assurances that "sensitive sectors such as agriculture and dairy have been protected."

Third, the $500 billion figure is officially aspirational. The statement reads: "India intends to purchase $500 billion of U.S. energy products, aircraft and aircraft parts, precious metals, technology products, and coking coal over the next 5 years." Intentions are not commitments.

Fourth, while the trade Joint Statement makes no mention of Russian oil, a separate White House statement announcing the removal of the punitive 25 per cent tariff was unambiguous: "India has committed to stop directly or indirectly importing Russian Federation oil." This is now on the record. Whether India can deliver remains to be seen.

The core asymmetry identified in this article is now documented in the official text. India eliminates or reduces tariffs on "all" US industrial goods; the US applies 18 per cent tariffs on Indian goods and promises to consider lowering them further during future BTA negotiations. The framework confirms what the announcement suggested: India is offering substantially more than it is receiving.

Further Reading

Carnegie Endowment: "The Trump-Modi Trade Deal Won't Magically Restore U.S.-India Trust" by Evan A. Feigenbaum

Atlantic Council: "What to Know About the US-India Trade Deal" by Michael Kugelman and Mark Linscott

Stimson Centre: "Implications of US-India Trade Announcements" (multi-expert roundtable)

The Diplomat: "Did Trump Jump the Gun With the US-India Trade Deal Announcement?"

The Wire: "India-US Trade Deal: The Many Things We Still Don't Know"

The Wire: "'Caution Not Celebration': Trade Analysts React to US-India Agreement"

Outlook India: "US-India Deal: What We Know and Unanswered Questions"

Business Standard: "India-US Trade Deal: Why Trump's $500-Billion Export Claim Raises Doubts."

Carnegie Endowment: "The Impact of US Sanctions and Tariffs on India's Russian Oil Imports" (November 2025)

CNBC: "Russia Says India Hasn't Said It's Going to Stop Buying Its Oil"

CNN: "India Has Been Importing Roughly 1.5 Million Barrels of Russian Oil Each Day"

Al Jazeera: "Modi, Trump Announce India-US 'Trade Deal': What We Know and What We Don't"

The Federal: "India-US Trade Deal: Is It a Win or Strategic Compromise?" (Capital Beat discussion)

Milling and Grain: "US-India Trade Deal: Reactions of Farmers and Agribusinesses"

Council on Foreign Relations: "A Field Guide to U.S.-India Trade Tensions"

Observer Research Foundation: "Understanding India-US Trade Tensions Beyond Trade Imbalances"

ORF: "Understanding the Impact of GSP Withdrawal on India's Top Exports to the US"

CNBC: "Trump Refuses to Be Outdone by Europe, Signing His Own U.S.-India Trade Deal"

World Economic Forum: "India-EU 'Mother of All Trade Deals': What to Know"

Varna is an independent development economist. She writes at policygrounds.press.

Write a comment ...